By Stephen Gray, Vertical Research Manager at Facebook

To understand behavioral shifts in existing mobile gamers, Facebook Gaming and Facebook IQ surveyed people in 9 countries to look at consumer behavior after March 2020. This article delves into findings from key strategic markets for many developers: US, UK, Germany, and South Korea.1

Here we examine 3 key findings from the survey:

To discover more about what’s changed over the last year and how gaming companies can adapt and reemerge in the year ahead, download the full Games Marketing Insights for 2021 report.

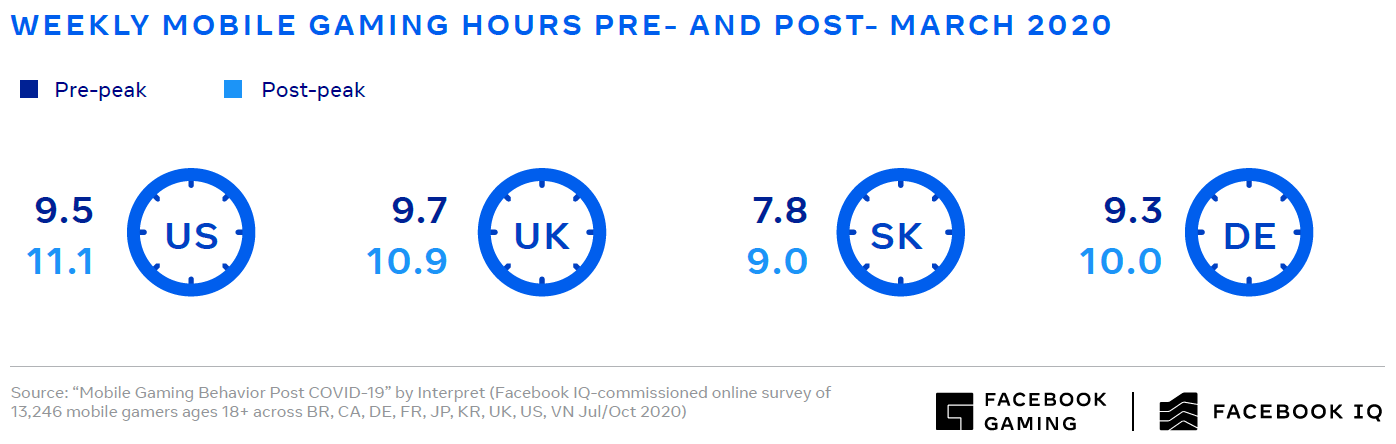

In all countries, existing gamers reported that they currently spend more time gaming than they did pre-pandemic. This is driven by longer gaming sessions rather than more frequent ones. 40 percent of US gamers, 40 percent of UK gamers, 53 percent of South Korean gamers, and 30 percent of German gamers reported that their typical gaming session has increased in length since March 2020.

A large portion of gamers in all markets reported spending more time playing single-player games on their own since the pandemic (US: 49 percent, UK: 43 percent, South Korea: 51 percent, Germany: 29 percent). A notable number of gamers also reported spending more time playing games with friends/family members online (US: 30 percent, UK: 26 percent, South Korea: 35 percent, Germany: 21 percent).

We asked gamers to compare their behavior before and after March 2020 on a number of different gaming activities. In all markets, many gamers reported increasing the time they spent playing single-player games specifically (US: 49 percent, UK: 43 percent, South Korea: 51 percent, Germany: 29 percent ), which was the largest increase in time spent. However, there was also a notable number of gamers who reported spending more time playing games with friends/family members online (US: 30 percent, UK: 26 percent, South Korea: 35 percent, Germany: 21 percent) as a way to connect.

We wanted to dive deeper into understanding the use of mobile games as a way to connect to others online. With this in mind, we talked to gamers to learn more about shifts in gaming behavior since the onset of the pandemic. Here are a few highlights:

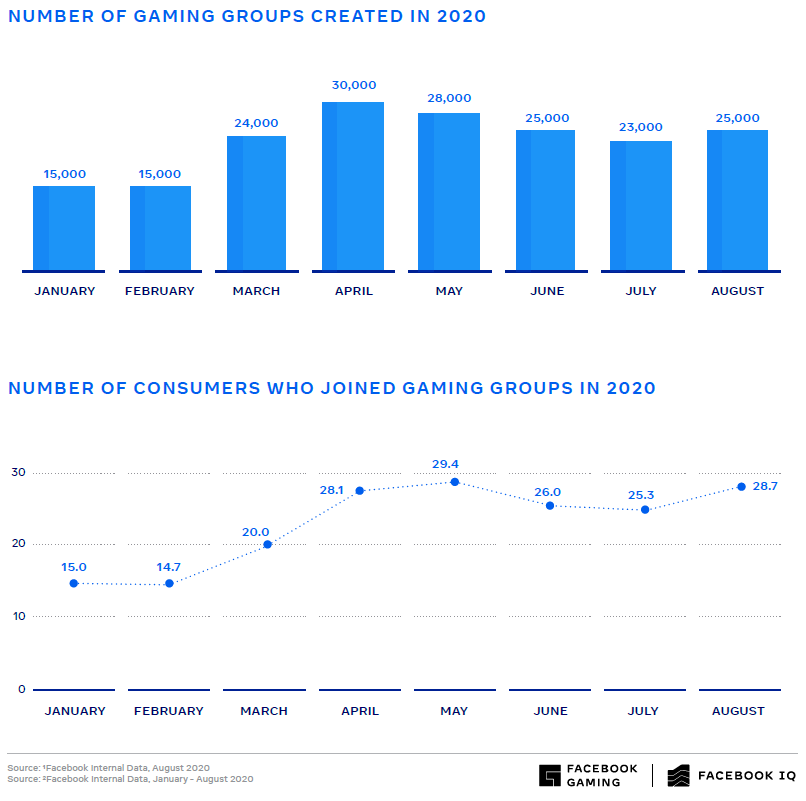

We also looked at changes on Facebook in Gaming Groups activity since the beginning of the year. Active members in gaming Groups on Facebook, as well as the number of Groups, grew during the months following the outbreak as people connected with their gaming communities. From January to August 2020, over 185,000 new gaming Groups were created and over 130 million members joined gaming Groups. Currently, there are more than 230 million people who are active members in over 630,000 gaming Groups on Facebook per month.

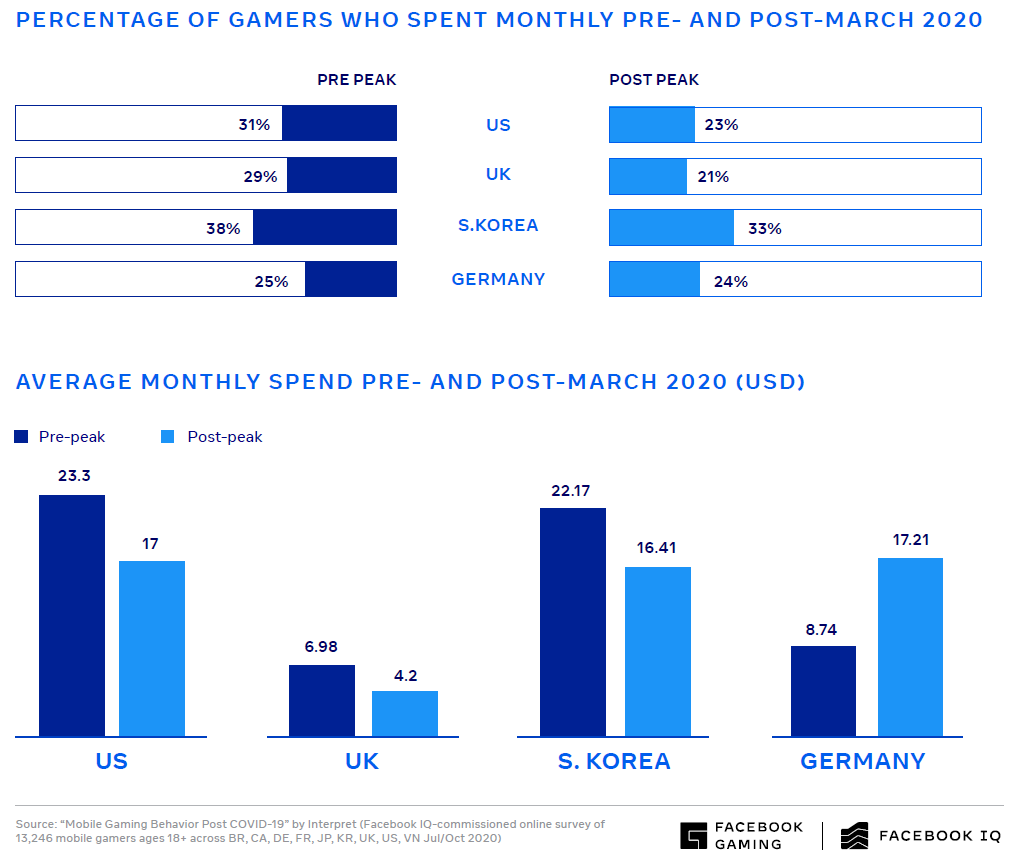

In the US, UK, and South Korea, fewer existing gamers reported spending money compared to pre-pandemic. The gamers who did spend money reported spending less money per month than before the pandemic. On the other hand, in Germany, people reported being equally likely to spend pre- and post-COVID-19, and actually reported spending more money per month after the onset of the pandemic.

To learn more about this audience, and access exclusive stats and research to help you prepare for the 2021 gaming landscape, download Games Marketing Insights for 2021 for free now.

1. Source: Stats in this article are taken from the 2021 Facebook Gaming Marketing Report, Facebook, 2021.

GameDaily.biz © 2025 | All Rights Reserved.

GameDaily.biz © 2025 | All Rights Reserved.