The business of video games continues to boom, and investors want a piece of the action. That’s the overall message from two separate reports released today from DFC Intelligence and Digi-Capital, respectively. According to DFC, game spending on software alone should grow from $118 billion in 2018 to $164 billion in 2023. At the same time, dedicated game console systems and PC game rigs is expected to drive spending on hardware to more than $80 billion by 2023.

In just a few years, the total games business could be worth nearly $250 billion, making it the largest entertainment sector in the world.

“This rapid growth is driven by mobile games and emerging markets, but also by a growing number of high-end gamers looking for powerful game systems,” DFC noted in its report.

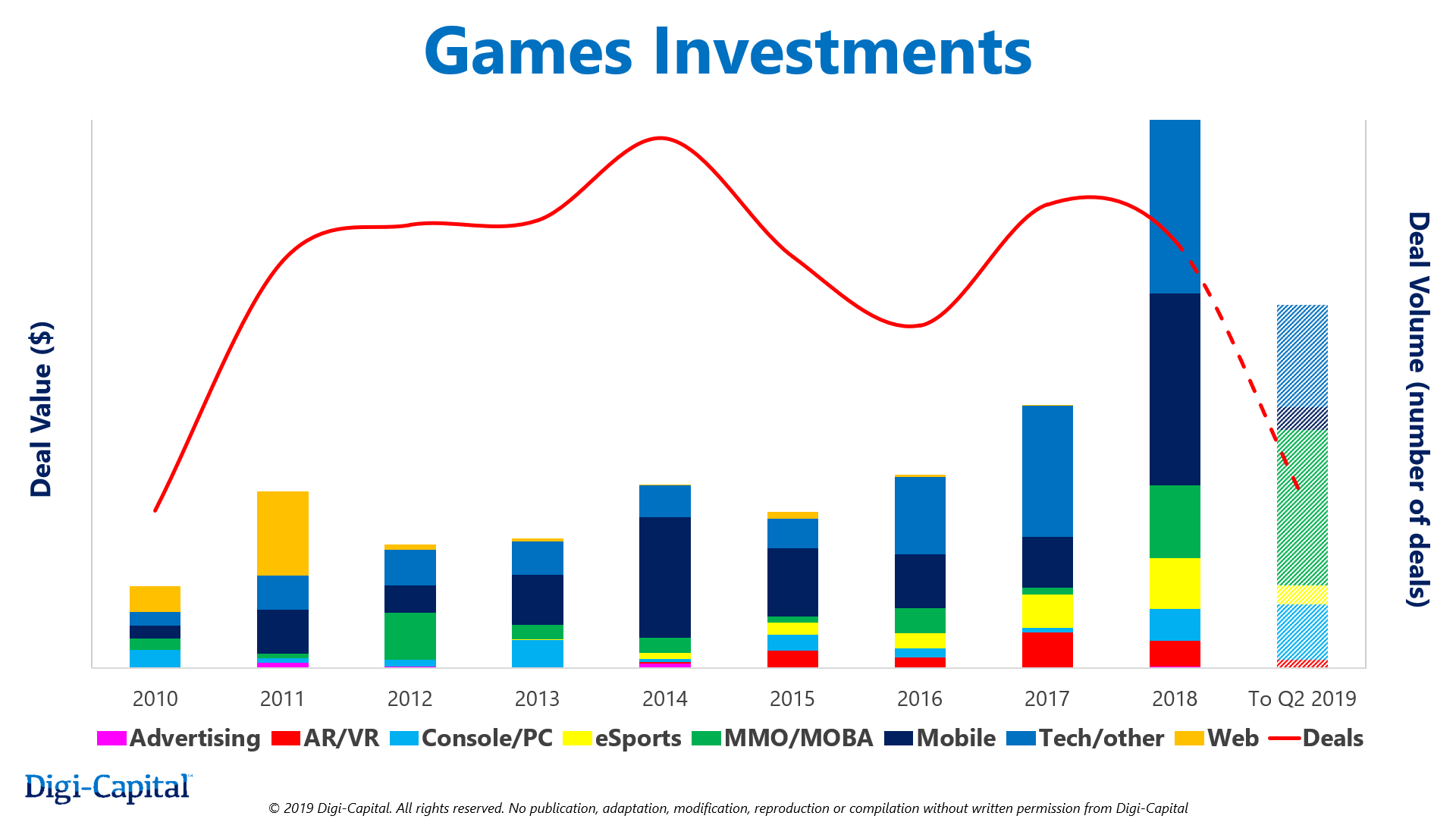

Where there’s lots of consumer spending, of course, investors are going to want to get a piece of the growing pie. According to Digi-Capital’s newest report on investments and M&A activity in the games industry, the last 18 months for games have been record setting. Between VC and strategic game investors, the industry has seen $9.6 billion in total investment over the 18-month period, which Tim Merel, Managing Director of Digi-Capital, pointed out makes it “equal to the previous five years’ games investments combined.” Moreover, if this pace of investment continues, it could end up making 2018 and 2019 games fundraising” higher than all investments from the previous eight years combined.”

Digi-Capital estimates that games revenue for hardware and software will hit $200 billion by 2023, which is slightly more conservative than DFC’s figure. Merel added that this surge does make the industry “highly attractive for major operators.”

In an email to GameDaily, Merel outlined the top sectors for game investment over the last 18 months:

He also provided a list of who the largest games fundraisers were during this period:

It’s worth noting that the top fundraiser on that list, SEA Limited, was formerly known as Garena, a Singapore-based online games portal founded in 2009. The company operates a number of online titles in Southeast Asia, including League of Legends, and generates revenue from in-game microtransactions. Like the number two fundraiser on the list, Epic Games, Chinese conglomerate Tencent owns a significant stake in the company.

Tencent did not make the list, but China in general controls a rather large portion of all games industry financing. YY, DouYu, Shanda, and Huya are all based in China, and even Dreamscape Horizon, a subsidiary of Hong Kong’s Leyou, received a massive investment from China’s Meitu earlier this year. Only the bottom three on Digi-Capital’s list — THQ Nordic, Voodoo, and Niantic — appear to have no Chinese investment thus far.

At the same time that games investments have risen to record levels, Digi-Capital found that M&A activity plummeted in 2019 to levels not seen since 2010. M&As and IPOs combined dropped to $1.1 billion for the first half of 2019, a stark contrast to the $22.4 billion M&A activity generated for all of 2018, which was the second highest level ever recorded, according to Digi-Capital.

Merel noted that mobile games were the driving factor for 66% of all M&A activity over the last five years, while PC games, especially in the MMO/MOBA category, drove 18% of activity. The sharp decline in 2019 so far “has not been made up by other sectors.”

He added, “The largest pools of recently unrealized capital (i.e. last 18 months’ games investment compared to games M&A in the first half of 2019) are in esports at 292x, games tech/other (games engines, games streaming etc.) at 31x, mobile games at 29x and MMO/MOBA games at 20x. While there could be significant exits for specific games companies in these and other sectors in coming years, a broader catalyst might be needed for all this money to deliver a return.”

Merel warned that the contrast between heavy investment in recent years but considerably slower M&A and IPO activity could result in a “financial overhang.” He noted that the industry is “largely consolidated” and the lack of exit activity (Nexon canceling its own sale, for example) could be an indicator of a slowdown.

“Strategic games investors operate with long term commercial returns in mind, but VCs are more geared towards a 10x return on investment and shorter investment horizons. VCs have also been historically wary of games investment because of their hit driven nature.

“So while games investors have become braver in the last 18 months, their enthusiasm could have unintentionally created a financial overhang in the context of the current games exit market,” Merel explained.

GameDaily asked Merel about the impact of other emerging tech such as cloud gaming on the investment world. Clearly, Google, Microsoft and others are invested, but when it comes to VCs and strategic investors, it’s “too early to tell,” Merel advised. The picture around cloud gaming and what impact it has on the industry’s financing should become clearer in the next 12 to 18 months.

GameDaily.biz © 2025 | All Rights Reserved.

GameDaily.biz © 2025 | All Rights Reserved.