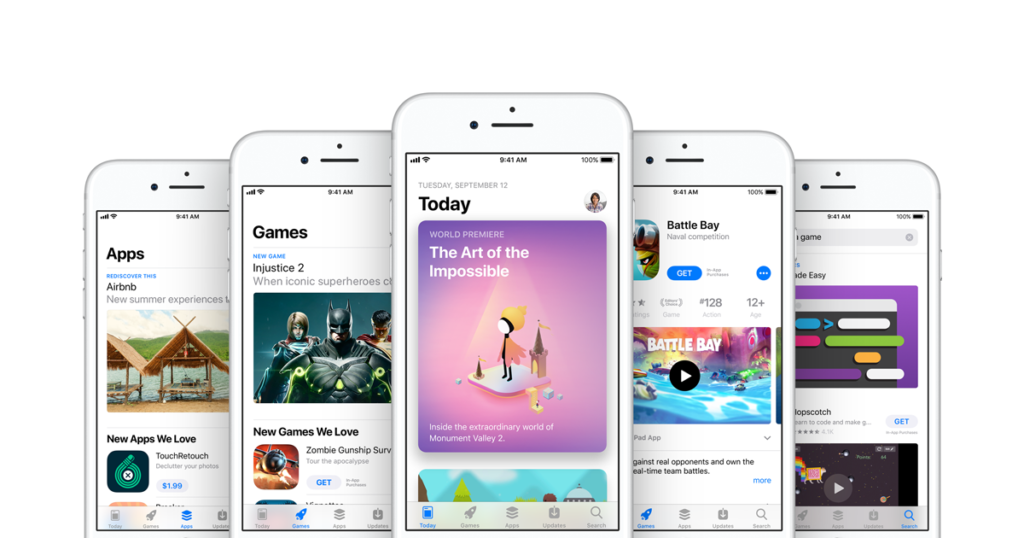

If you own an Apple mobile device or tablet, your commercial applications come from the App Store. The Cupertino-based company prides itself on an ethos of “it just works,” which means creating a single point of entry for media and applications like productivity software and games.

That approach is now putting Apple in the crosshairs of both app developers and the United States government.

A complaint has been filed in United States federal court in the Northern District of California by Donald R. Cameron (creator of baby name app, Lil’ Baby Names) and Pure Sweat Basketball, app developers that publish on the App Store. The suit alleges that Apple’s 30% platform fee (an industry standard prior to Epic disrupting the marketplace with its 88/12 split) and $99 annual developer fee are “supra-competitive” and unsustainable.

Further, Cameron and Pure Sweat Basketball assert that Apple has established a monopoly by disallowing any restricting access to devices and requiring sales through the App Store.

“While Apple is fond of pointing to impressive-sounding sales numbers and dollars earned by developers, nonetheless, its exorbitant fee for distribution (or retail sales) services, coupled with its $99 annual fee and pricing mandates, have cut unlawfully into what would have been developers’ earnings in a competitive landscape,” the filing reads.

Attorneys representing Cameron and Pure Sweat Basketball are leveraging the Sherman Antitrust Act to make their case. The law states that “Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony.”

The question becomes whether the App Store is a monopoly as intended in the Sherman Act. Attorney Richard Hoeg of the Hoeg Law Firm suggests that this might be a stretch.

“Determining whether a monopoly exists hinges in large part on how you define the ‘part of the trade or commerce’ concept,” Hoeg told GameDaily. “That is, what is described in the complaint as the ‘relevant market.’ In other words, Apple has a monopoly in things that run in the ecosystem that it has invented. I think for most people a definition like this immediately rings false. Everyone is a monopolist under this rationale.”

The complaint hedges against this by stating that even if the court deems that iOS apps aren’t the correct definition of the market, that Apple controls enough of the distribution that it can exert a monopoly.

“In my opinion, then, Apple should be permitted to set the parameters of playing in its ‘garden’ and there are plenty of other places to go if you don’t like their terms,” Hoeg said. “The most pertinent inquiry in the entire complaint is, ‘What is the relevant market?’. I don’t think the plaintiff makes a compelling enough case for the applicability of Sherman. California might well take a more protective view.”

Apple’s “walled garden” approach is no different than games sold digitally on PlayStation Network, the Xbox Marketplace, or the Nintendo eShop. Each of these also takes a 30% platform fee off the top for any software and in-app purchase sales.

The suit against Apple also draws a direct connection between the company’s alleged monopolistic practice and discoverability issues. The complaint states that if there were app store competition, Apple would be forced to reduce its platform fees to remain competitive. That is not borne out by Android apps, which may be purchased from the Google Play store or other digital storefronts. Google continues to charge a 30% platform fee, identical to Apple’s.

“Because there are so many apps available in the one iOS App Store that exists, due to Apple’s usurpation of the entire marketplace, huge numbers of apps necessarily get lost,” the complaint reads. “Apps buried among the 2 million+ available apps7 do not sell because no one sees them, leading to less distribution transactions for apps and in-app products. If Apple did not shut out all competition from access to iOS device owners, there would be more stores that could feature more apps, as well as stores that would specialize in certain kinds of apps. Overall, this would boost output in and sale distribution transactions because more apps could be featured, such that more buyers would see and buy them.”

The lawsuit is compounded by a potential US Department of Justice probe that seeks to determine if Apple is engaging in anti-competitive practices. Word of the investigation comes after the United States Supreme Court ruled that consumers could initiate legal action against platform holders for inflating digital software prices by demanding a 30% cut. Facebook, Amazon, and Google are also in the crosshairs.

“I don’t think the SCOTUS decision in Apple v. Pepper should be underplayed here,” Hoeg explained. “That case opened up the suggestion that the supreme court of the land might be willing to move against the tech companies in ways not previously considered. I believe that decision directly led to some of the anti-trust rumblings and this lawsuit.”

A government investigation may not have any material impact on this case, though (especially as it has not been formally confirmed). Though it likely will be used as ammunition by the plaintiff’s attorneys.

“Its very existence will undoubtedly be used by the Plaintiffs to backstop their theories,” Hoeg said. “That said, the DoJ investigation is likely to be slow-moving, and unlikely to have real findings or discoveries that could be used by a commercial plaintiff on the timeline that they would need. The wheels of justice move slowly, as they say, and so I think one will not likely impact the other, primarily because there will be no ‘results’ on a reasonable timeframe.”

If the plaintiffs are successful in this case or the Department of Justice does determine that there’s a monopoly at play, it could drastically change how we purchase digitally distributed software. If platform fees and walled gardens become viewed as monopolistic, the impact would be felt across a number of industries and potentially upend how Microsoft, Sony, and Nintendo especially view digital software and their rights to maintain storefronts and sell software on devices comprised of proprietary technology.

GameDaily.biz © 2025 | All Rights Reserved.

GameDaily.biz © 2025 | All Rights Reserved.