2018 is almost at an end. While we get ready to pour one out for one of the best years the game industry has seen in almost a decade, let’s take a look at the biggest trends (and stories) to come out of this year’s melange of disruption and wild growth.

Epic Games’ battle royale darling made a number of headlines this year, especially on GameDaily. Fortnite’s impact on the world can be felt in almost every facet of popular culture, including dance. But it’s Fortnite’s contributions to the game industry that have been reverberating and accelerating since the summertime, especially.

There aren’t many games out there that boast true cross-platform play. Minecraft and Rocket League have sure come close, as has Final Fantasy XIV, but Sony continues to be the thorn in everyone’s cross-platform sides. When Fortnite announced that it was coming to Switch, there was a massive outcry from fans when they discovered that their existing PlayStation 4 accounts couldn’t be used on their Nintendo Switch. Sony’s response was tone deaf at first, but Fortnite’s popularity wasn’t showing any signs of slowing down. So, Sony relented to the siren song of the 30 percent revenue-share.

As of today, Fortnite is the only game on the market that is truly cross-platform (with progression, as well as gameplay) across all major platforms and devices, including mobile (through iOS and the Epic Games Android installer). Its mainstream success has been a double-edged sword, with a reinvigorated moral panic around video games and children cropping up as a result, in addition to the incoming legal issues around Fortnite scraping dance moves from rappers like 2 Milly and TV shows like Fresh Prince of Bel Air and Scrubs.

As Fortnite and PlayerUnknown’s Battlegrounds have continued to permeate the game industry, popular first-person shooter games like Call of Duty and Battlefield have continued to refine battle royale into a true genre, rather than being relegated to a facet of another genre. As battle royale grows and finds its polish, Fortnite will have to find ways to reinvent itself to keep the momentum going, or it’s going to find itself awash in competition that wants to bash its loot llamas wide open.

Looking Ahead

One of the biggest opportunities for Fortnite in 2018 has been its cultural permeation. That cultural awareness has helped Epic capitalize on one of the biggest pop culture events of the year: Avengers: Infinity War. Fortnite partnered with Disney-Marvel in May of this year for a mashup event that was almost universally beloved. The limited event was a reflection of the game’s incredible cache in popular culture.

In 2019, Epic will need to continue these kinds of thoughtful collaborations to stay in the mainstream collective consciousness. It’s arguable that even the dance emotes, many of which are a combination of social dances and popularized dance moves from pop culture icons, will have to remain fresh in order to keep people interested in that kind of microtransaction content.

Even though Epic Games isn’t likely to rest on its content-laden laurels, they’ll need to stay sharp and nimble in the wake of stiff competition. PlayerUnknown’s Battlegrounds is starting to creep up the mobile charts, with a whopping $33 million in revenue for November, outstripping Fortnite’s monthly revenue by almost $10 million.

And with PUBG Mobile threatening to start chewing at Fortnite’s ankles, Epic will need to consider the eventuality of Fortnite’s decline. It’s not looking like that’ll be the case anytime soon, especially with the serious bank the cartoonish battle royale continues to make on a daily basis on all platforms. 2019 will pull Epic in a number of directions, including its own storefront, so the company will need to continue to be savvy and laser-focused on creating engaging events and content that keeps its players coming back for more.

Steam’s had a rough year for developer goodwill. First, its bizarre content policy that was so esoteric that it became damaging to adult game developers. Then Valve decided to do the exact opposite of what the indie development community needed them to do by introducing a revenue-sharing model that rewarded high-volume sales. (Likely to try to woo back the triple-A publishers that had moved their games onto their proprietary launchers.) And, of course, there’s the ongoing problems with digital discoverability, made worse each year by the sheer volume of games being released on Steam.

As the biggest publishers leave the platform in droves — most recently, Activision’s move to Battle.net and Fallout 76‘s release on the Bethesda launcher — developers are asking the question: what have you done for me lately?

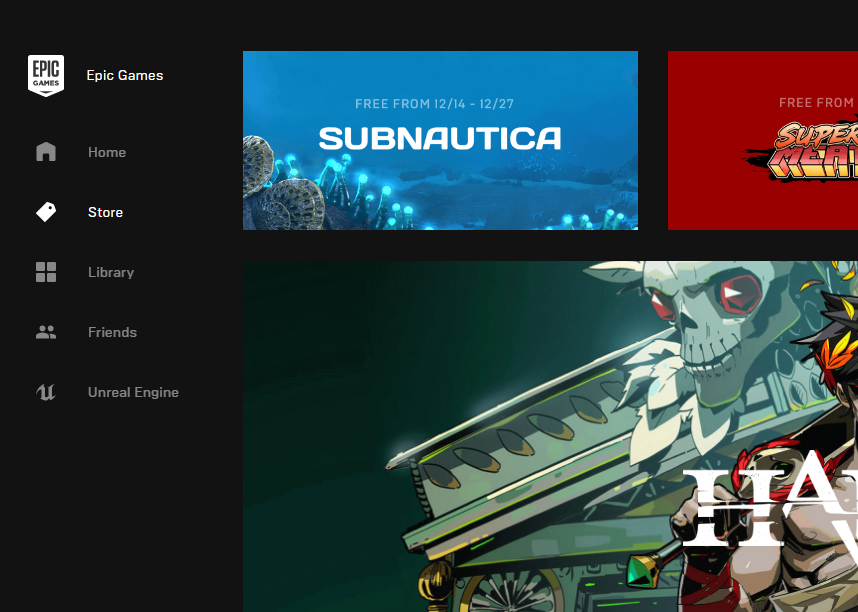

Epic Games Store, Discord, and Robot Cache all have answers to that tantalizing question and it’s in the form of rewriting the rules of what’s become the industry-standard rev-share. Epic Games announced that its storefront would offer a rev-share of 88/12, echoing what the company did for Unreal Engine creators. Discord followed that up with its assertion that they only need 10 percent of revenue to keep the storefront going (and they’re looking to whittle that down even further.) And finally, Brian Fargo’s blockchain-powered storefront, Robot Cache, has boasted a 95/5 rev-share while also allowing consumers to resell their “used” digital games.

We’ve talked about this at length on the GameDaily BizCast, highlighting the opportunities and challenges that the storefronts will be facing in this relatively uphill battle for consumer attention. The biggest issue that these storefronts are going to have is in helping customers break the “Steam habit” — a platform putting more money in developer pockets isn’t enough of a draw for mainstream game consumers. There needs to be a clearly defined unique selling proposition.

Looking Ahead

Epic and Discord just fired the first shots in what is likely to become a battle for mindshare and consumer spending. Price is only one factor in winning over developers and consumers.

Key partnerships, like Discord’s “First on Discord” program and Epic’s wooing of exclusivity deals are a big first step. As we discussed on our year-end episode of the BizCast, though, anyone vying for the crown is going to need to get creative. That means finding ways to make the revenue split and other platform differentiators matter to end-users.

One possible way to make developer revenue matter to consumers is to pass on some of the savings. The 18 to 20 percent difference between Steam and Epic Games Store and Discord respectively give developers some price flexibility. On top of that Discord has suggested it’s looking at finding additional operational savings to improve the revenue share for developers. Instead of passing all of that on, Discord (and Epic, for that matter) could set up a fund to match discounts (up to a predetermined limit) with some of that extra money.

Some users are also lamenting that Discord and Epic Games Store aren’t as feature-rich as Steam is (yet). For those that matter, both of the new entrants need to determine if they’re going to fulfill those needs and how. Price isn’t the only factor in play, even though it’s arguably one of the largest, making it an obvious place for Discord and Epic to focus first.

Once the pieces are in place, customer retention becomes the focus. And that’s far easier (and less expensive) than acquisition. Discord and Epic need to collectively find the tipping point from being Steam also-rans to becoming true peers. It won’t be until the threat of market share erosion becomes reality that Valve will start to feel pressure to change its relationship with developers.

2019 will be about making the case with consumers, because developers seem to be on-board with the idea of making more money for each copy sold. And really, who can blame them?

Nintendo fans stood by the House of Mario when everyone else thought the company’s brighter days were behind it. The sun is shining bright in Nintendo Land again, as stalwart fans and those that lapsed during the Wii U era are eating up the Switch.

Most recently, the hybrid console became the fastest selling console of the generation, besting the Xbox One and PlayStation 4. The company is continuing a powerful trend of strong first-party title attach rate, with a steady stream of well-received releases. This continues to drive hardware adoption, with Pokemon: Let’s Go Pikachu and Pokemon: Let’s Go Eevee the latest releases to power onto the NPD rankings.

Additionally, the two-week-old Super Smash Bros. Ultimate has already taken the crown as the best-selling game in franchise history. With 3 million units already sold at retail, according to NPD, it might be the biggest crossover in history (sorry, Avengers: Infinity War). This, of course, doesn’t include digital sales via the eShop. Smash is also the fastest selling Nintendo home console game in history in Europe.

The one potential pitfall in Nintendo’s 2018 is an ambitious hardware goal set for the fiscal year. As of the mid-year financial results, the company had only moved a hair over 5 million consoles against a full-year goal of 20 million. The most recent NPD report tells us that November was a stellar month across the board for console manufacturers, with each selling at least 1.3 million units in the United States alone. If the rest of the world has as strong a third quarter, Nintendo could have a merely challenging fourth quarter from January to March instead of one with an impossible goal. If Nintendo doesn’t think it can reach 20 million units after accounting for sales through December 31, it will likely revise its projection downward.

Nintendo is also the last major player in the toys-to-life market. Thanks to Super Smash Bros. Ultimate, we can expect new amiibo figures for all the new fighters. We’ll also get re-releases for those hard-to-find characters. The only other toys-to-life entry in 2018 was Ubisoft’s Starlink (another shining moment for the partnership between the French publisher and Nintendo).

While the exclusive Star Fox content and an attractive Arwing toy made the Switch version the one to play, the entire line of toys and the starter packs (across platforms) are heavily discounted. Thankfully, the digital version gives fans who don’t want the clutter of physical toys a way to play the full game without fiddling with plastic.

Nintendo used 2018 to turn its perennial handheld success back into home market dominance. With an enormous slate of third-party releases, typically powerful first-party offerings, and a form-factor that distinguishes the Switch from everything else out there, Nintendo is riding high on consumer and developer goodwill. But there are some potential bumps in the road…

Looking Ahead

The eShop is crowded and it’s only getting harder to navigate with every week. Nintendo said in July it wanted to roll out 20 to 30 new releases each week and it certainly has done at times this year. While fans continue to be delighted when indie games get Switch ports, the eShop infrastructure isn’t keeping up. The eShop needs better search and filtering features in 2019. Developers are still eager to put their games on the system, but that can change if sales start dipping due to discoverability problems.

Nintendo is also primed in 2019 to release an updated version of the Switch. The company has adopted that paradigm with its portable consoles in the past. It’s also emboldened by Sony’s release of the mid-cycle PlayStation 4 Pro and Microsoft’s two updated Xbox One versions (the S and the X). Better battery life, more storage, a lighter design, and a higher fidelity screen that might also support a stylus (how else can we play Persona Q on Switch?) would all bring existing owners back for a double-dip. This would also give Nintendo room to lower the original Switch’s price and, at the same time, keep sales strong in the console’s third year.

Strong first-party releases in 2019 will support hardware adoption. Metroid Prime 4, Fire Emblem: Three Houses, Marvel Ultimate Alliance 3, a new main-series Pokemon game, Bayonetta 3, and others are going to keep the drum beat going next year. Each new exclusive helps drive console sales, and Nintendo is not leaving huge gaps in the schedule anymore.

Nintendo could opt to hold a likely Switch hardware revision until Microsoft and Sony announce their next console cycles. This very well might not be until 2020. Waiting for that moment keeps Nintendo in a conversation that might otherwise bury the Switch in competitors’ hype.

In 2019, we also expect to finally say goodbye to the 3DS. Nintendo has been slowly shifting away from its handheld, with many of the major first-party releases updates of original DS entries. While we’ll never forget Street Passes and Find Mii, Switch market saturation has reached the point at which Nintendo can safely sunset the 73 million unit-selling 3DS (and its many variations).

Finally, it’s time for Nintendo to get on the streaming train. Whether it’s an official Twitch app or deepening a relationship with Microsoft via baked-in Mixer support, the Switch would benefit from a direct live feed. Back in 2014, Nintendo of America President Reggie Fils-Aime said that streaming games “is not fun.”

Things have changed for Nintendo in the past four years. The company largely shied away from ultra-violence and crude humor during the Wii and Wii U eras. The Switch, by contrast, is home to Doom, both Ubisoft South Park RPGs, and the upcoming Mortal Kombat 11. No one is looking at Nintendo home consoles as “kiddie” options anymore. Nintendo has successfully re-engaged the core gamer in the living room. Streaming service support would be a smart complement to Nintendo’s current approach to content.

2018 has been a whirlwind year for cloud gaming. During this year’s E3, EA talked to GameDaily about “Project Atlas” and how the publisher is looking to enable better cloud gaming services. We previewed Blade’s Shadow cloud gaming service (and mostly loved what we saw). They’ve received additional investment from Charter Communications, helping the French company to solidify their foothold in America, as well as enabling the ability to expand into other parts of the US and Europe. (Hopefully into Canada, too.)

We’ve also seen the advent of browser-based cloud gaming, thanks to Google’s Project Stream and its partnership with Ubisoft. Microsoft’s entrance into the cloud gaming arena wasn’t all that splashy, but the company is clearing mapping out what it wants the next Xbox generation to look like.

As much as this year has been big for the cloud, even at Unity, 2018 was about setting up the framework. 2019 and 2020 is where we’ll see the biggest strides among platform holders (new and established).

Looking Ahead

The road ahead for cloud gaming will be checkered with roadblocks, failure, and serious pivoting in the face of setbacks. EA has said that Project Atlas is still years away from being viable (which means it’ll be at least 2020 until there’s more news). Shadow is only available in select places in the US, though admittedly a lot more places than we originally thought. It’s still kind of unreliable, depending on the laptop you’re using (and the operating system you’re utilizing). There’s not enough information about both Google’s Project Stream and xCloud for anyone to make educated guesses about that future, either.

The biggest hurdle that all of the cloud gaming services are going to have to overcome will be centered around infrastructure. Huge swaths of the country doesn’t have fiber optic internet, making it difficult to make use of existing cloud gaming services, let alone giving the platforms an opportunity to test the average use-case.

Without education and adequately laying out why a consumer would need one cloud gaming service over another (or in addition to the others), consumers may opt out entirely, preferring to stick to what they’ve got, rather than take a chance on relatively unproven technology. Why should a consumer pay monthly for Shadow on PC, as well as xCloud or Project Stream in addition? Why not just one?

It’s the same kind of problem that we’re seeing among cable-cord-cutters: paying for Netflix, Hulu, Amazon Prime Video, etc. seems counterintuitive on first glance.

And, finally, there’s the problem of price. Shadow is $35 a month to use a full virtual machine that runs on Windows and there are no prices available for xCloud or Project Stream at the moment. If we loop in video game subscription services like Xbox Game Pass and PlayStation Now, we’re looking at a lot of money per month for streaming and cloud gaming. Even the attractive notion of a new Xbox that only runs on the cloud (and is available to lease-to-own) doesn’t negate potential consumer confusion.

The next two years are going to be a proving ground for these platforms as they dig their roots in and fine-tune messaging and value proposition for consumers. If Microsoft and Google are smart, they’ll snap up Blade’s Shadow in an acquisition and have most of the work done for them.

2018 has been a year of sunlight cast into the darkest shadows of the video game industry. Multiple stories throughout the past 12 months have given us a better look at working conditions inside studios. While it’s still possible to buy and play games without understanding how they are made, it’s certainly getting harder to separate the art from the conditions under which is created.

It started in January with Detroit: Become Human developer exposed by French newspaper Le Monde, Canard PC, and Mediapart for toxic work conditions. The accusations included examples of Quantic Dream employees being photoshopped onto the bodies of nude people, people in Nazi attire, or adorned with homophobic slurs. The studio sued the outlets, with resolution pending. In the meantime, the company did lose a suit filed by one of the employees depicted in the images, with courts deeming that the individual did suffer harassment and had reason to leave over the incident. (The United States legal equivalent would be a finding of “constructive firing,” which occurs when harassment or mistreatment prompts someone to voluntarily leave a job.)

This was quickly followed in March by The Verge’s Megan Faroukhmanesh’s outstanding expose about Telltale Games’ working conditions. The studio, which since entered a majority shutdown and has most recently turned over its assets for liquidation, was criticized by a number of former employees for extended crunch conditions, a stifling creative environment, and leadership that was more interested in personal glory than team success.

It wasn’t until Kotaku’s Cecelia D’Anastasio explicitly detailed League of Legends developer Riot Games’ long history of workplace sexual harassment that the video game industry caught up with Hollywood’s Me Too movement. The results of D’Anastasio’s work has led to Riot hiring corporate culture expert Frances Frei. Current and former Riot employees are suing over gender discrimination and their treatment at the company, and the studio has made a public show of suspending chief operating officer Scott Gelb for inappropriate touching.

The discussion about workers rights in the game industry reached fever pitch after tales of excessive crunch at Red Dead Redemption 2 developer Rockstar Games came out. Hints of 100-hour work weeks first appeared in a breathless interview featured on Vulture, but it was Kotaku that dug in to get a number of comments from current employees. All eyes were on the game industry in 2018, with journalists, developers, and consumers have out-loud conversations about what it means to be a developer in 2018.

It also added significant fuel to the conversation about developer unionization both in the United States and abroad. After discussion of unionization got underway with a standing-room-only meeting at GDC, each new story of problematic workplace culture spurred conversation further. 2018 ends with the UK is now home to a trade union, Game Workers Unite UK. This is clearly only the beginning.

Looking Ahead

2018 had a brutal honesty to it that the industry hasn’t allowed itself to have in a long, long time. Game workers didn’t exactly shout, but they were heard nonetheless. Tales of crunch and systemic abuses at studios that have been both revered and beloved by mainstream gaming consumers shook a number of us to our core.

But if the pain of the plethora of game workers was useful for anything, it will be to serve the demand for increased transparency among triple-A publishers and developers. We might see other studios come under fire for harmful development practices or toxic corporate culture. Consumers (and the media) won’t be wooed by the game’s packaging if the game was damaging for the creators behind the curtain. The complex conversation surrounding whether or not people should boycott Red Dead Redemption 2 or The Walking Dead: The Final Season in solidarity for developers was, for the most, nuanced. Creators should be rewarded for their hard work, but there’s also the notion of “voting with one’s wallet.”

That added transparency will further drive conversations about how to improve the lives of game workers everywhere, from tiny indie developers and microstudios to the biggest publishers on the planet. There isn’t a clear solution ahead, but after the challenging issues surrounding unionization in the game industry, there will be harder conversations incoming next year.

For more stories like this one delivered straight to your inbox, please subscribe to the GameDailyBiz Digest!

GameDaily.biz © 2024 | All Rights Reserved.

GameDaily.biz © 2024 | All Rights Reserved.